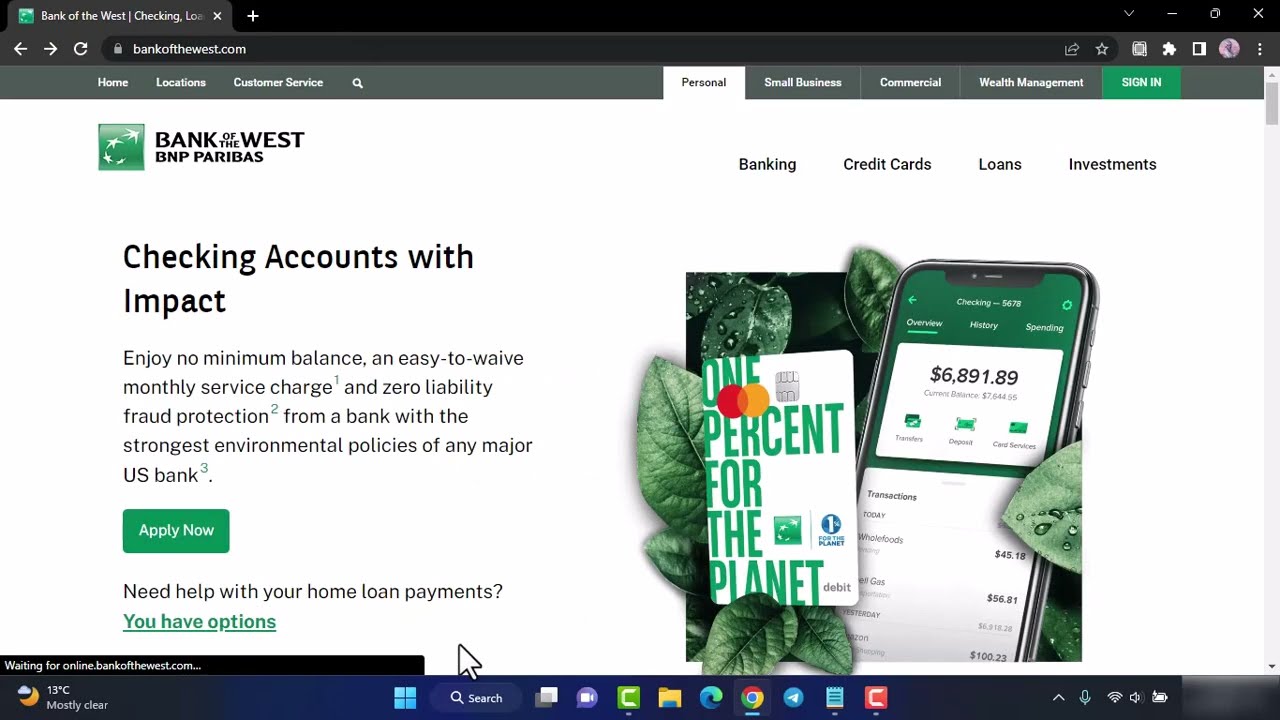

As the financial landscape continues to shift dramatically, banks are innovating at an unprecedented pace. With its finger firmly on the pulse of change, bankofthewest stands out as a leader in this evolution, harnessing technology to provide enhanced services tailored to meet the needs of today and tomorrow. In this article, we’ll explore seven significant innovations from bankofthewest that are reshaping customer experiences and financial accessibility.

7 Innovations by bankofthewest Utilizing Advanced Technology

One of the most exciting innovations at bankofthewest is its use of artificial intelligence (AI) algorithms. These algorithms analyze customer spending habits, offering personalized savings advice and financial planning. Imagine having a virtual financial buddy that helps you map out your budget and guides you toward your savings goals! This method fundamentally transforms how clients relate to their finances, allowing them to make better decisions.

Who doesn’t dream of magical family vacations? bankofthewest understands that families want to manage their finances while saving for unforgettable experiences. In a fantastic collaboration with MyDisneyExperience, the bank provides special rewards that help families save for adventures at Disney parks. Banking becomes more than just dealing with numbers; it’s about nurturing family memories while keeping finances in check.

Imagine looking at your financial future projected onto your living room wall! bankofthewest has incorporated augmented reality technology into its mobile banking app, revolutionizing how users visualize their financial paths. This innovative feature lets users engage with interactive financial literacy tools, making the process of planning their finances not just educational but also thrilling!

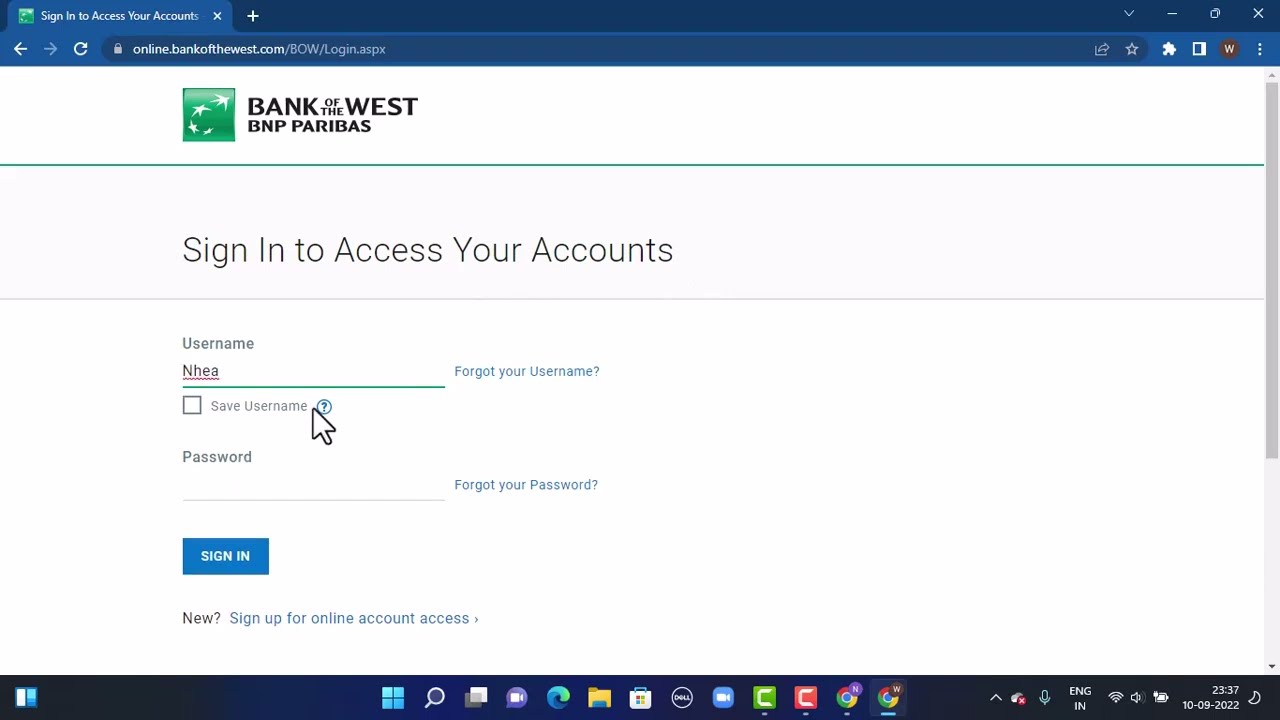

In a digital age where fraud runs rampant, having robust security measures is paramount. bankofthewest deploys cutting-edge fraud detection systems that monitor transactions in real-time. Thanks to machine learning, customers are alerted immediately to any suspicious activity, providing peace of mind. It’s like having a security guard watching your finances 24/7!

Safety and transparency are key in banking, especially for international transactions. bankofthewest has embraced blockchain technology, significantly reducing fraud risks and enhancing trust. By adopting this advanced solution, the bank leads the charge in offering secure banking options where clients can feel confident their money is safe.

Engaging financial education is a priority for bankofthewest. Through a partnership with Thestreameast, the bank offers live-streamed events that dive into personal finance topics. This innovative program helps cultivate a financially savvy customer base by making complex fiscal concepts accessible and enjoyable to all. Who wouldn’t want to learn about finances while tuning in to a live show?

As society moves toward sustainability, bankofthewest is getting in on the action. The bank has implemented eco-friendly banking options, from providing paperless statements to financing renewable energy projects. This initiative not only attracts conscious consumers but also positions the bank as a socially responsible leader in finance.

Empowering Customers Through Digital Innovation

The innovations at bankofthewest are more than just flashy tech upgrades; they represent a cultural shift within banking. The bank focuses on customer engagement and sustainable practices, placing itself at the forefront of a financial revolution. It prioritizes accessibility, transparency, and community support, all essentials for modern banking.

As we venture further into this era of digital transformation, bankofthewest serves as a shining example of how technology can enhance everyday banking experiences. Customers no longer have to feel overwhelmed by banking processes; instead, they can feel engaged and empowered in their financial journeys.

With these innovations paving the way, it’s evident that bankofthewest is not just transforming banking; it’s redefining how customers interact with their finances. It’s ushering in a future where financial well-being is attainable for everyone. It’s about time we embraced this revolution in the banking sector, where each transaction feels meaningful and where every customer is an integral part of their financial story.

In summary, with the dawn of these remarkable innovations, bankofthewest is not only enhancing banking but also elevating the entire experience of financial management. Whether you’re planning a Disney vacation through mydisneyexperience, learning from financial stream events, or investing in a greener planet, bankofthewest has truly transformed how we view and engage in banking. With a fresh perspective at every turn, it’s clearly a bank for the future.

bankofthewest: Banking Innovations That Transform Your Future

A Look at bankofthewest’s Legacy

Did you know that bankofthewest has been a staple in the banking world since it was founded in 1874? Over the years, this institution has evolved and adapted, much like the historical drama of The Tudors cast—reshaping narratives while sticking to their core values. Just as guaranty bank built its reputation on trust, bankofthewest emphasizes integrity and innovation in every service they offer. This commitment to progress helps clients navigate financial decisions similar to how one might tackle a complicated Guatemala map, illustrating the path to financial stability.

Innovative Services

Transitioning into modern banking, bankofthewest is well-known for its user-friendly technology. Clients can monitor their finances anytime using the popular Garmin Instinct 2, making fitness tracking and banking coexist seamlessly. While the world turns towards new tech tools, like mobile banking apps, customers find a balance between convenience and security. And just like Zain Iqbal accentuates storytelling in film, bankofthewest transforms how we think about finance, simplifying processes without sacrificing quality.

Community Commitment

What’s more, bankofthewest actively invests in the communities it serves. This dedication reflects how businesses thrive in places like Guangzhou Canton, where local engagement fuels economic growth. By supporting small businesses and environmentally conscious initiatives, bankofthewest isn’t just about profits—it’s about paving the way for a brighter, sustainable future. Their passion echoes the hospitality felt at historic venues like the Intercontinental New york barclay, where great service reigns supreme. So, keep an eye on this innovative bank; they’re shaking things up and make waves far beyond the typical banking guidelines, much like a good plot in a gripping show like Servant.