When it comes to managing your finances, the Chase Bank routing number is an essential piece of information that every customer should have down pat. This nine-digit code works like the personal ID for your bank, guiding your money to and from the right place. Whether you’re transferring funds, wiring money, or setting up direct deposits, knowing your Chase routing number can mean the difference between a smooth transaction and a major headache. Let’s take a closer look at why it’s so important and those secrets you might not know yet.

1. The Importance of the Chase Bank Routing Number

The Chase Bank routing number ensures that when you make a transaction, your money gets where it needs to go without delay. Picture this: it’s payday, you’ve worked hard all week, and your employer will deposit your paycheck straight into your account. If the wrong routing number is used, that paycheck could vanish into the void.

This number helps navigate electronic funds transfer and wire transfers efficiently. It’s like having a map for your financial transactions, ensuring you don’t end up lost in the banking jungle. Knowing your Chase routing number isn’t just good practice; it’s essential for keeping your finances on track.

Additionally, businesses rely on these routing numbers as well. Many small businesses utilize Chase routing numbers for vendor payments and payroll. With the right information in hand, you’re not just managing your own finances; you’re managing your business’ financial health too.

2. Top 5 Key Facts About Chase Bank Routing Numbers

2.1. Different Routing Numbers for Different Transactions

Now, that’s where it gets a tad tricky. Chase Bank assigns different routing numbers depending on the type of transaction. If you’re wiring money to your PayPal Pay in 4 account, you’ll need a specific routing number for that to go smoothly. Invest some time to understand which number to use for various transactions.

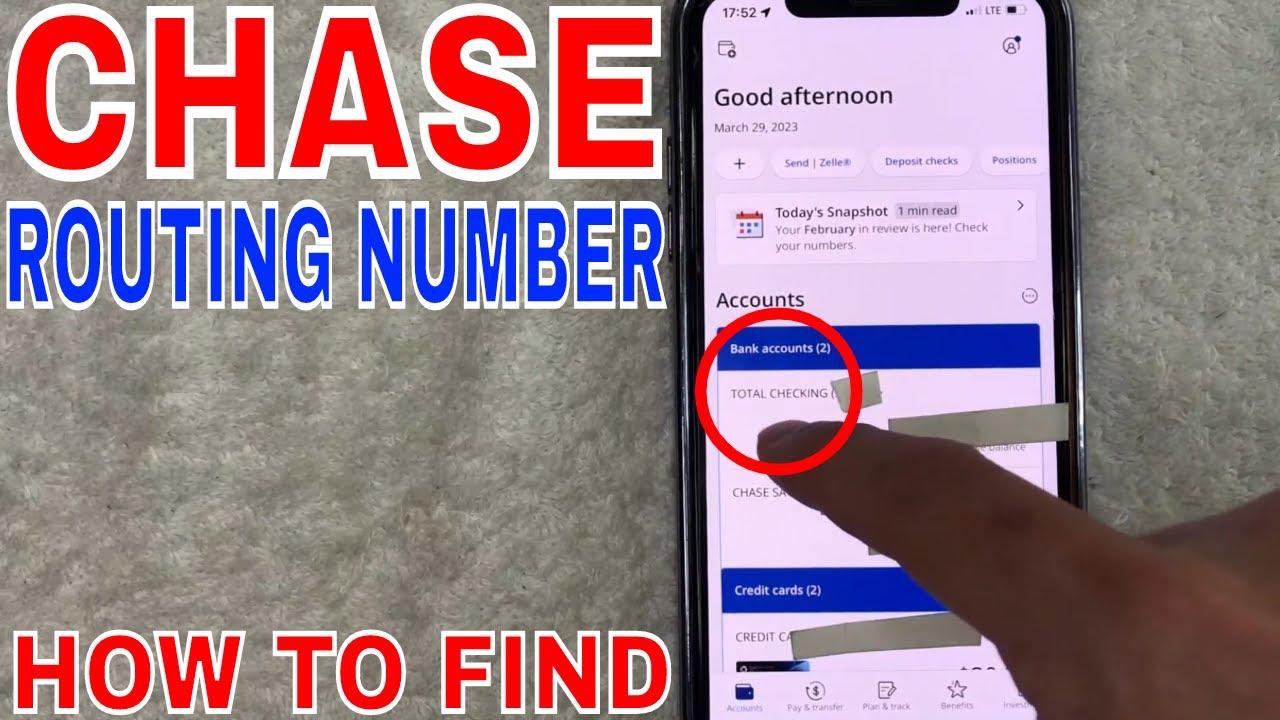

2.2. How to Find Your Chase Routing Number

Finding your Chase routing number isn’t rocket science. Look at the bottom left corner of your checks, and you’ll spot it there, nestled between the account number and the check number. Alternatively, this info is also available through the Chase Bank online portal. Don’t underestimate the power of customer service; if you’re confused, just call the USAA customer service number or Chase directly.

2.3. Using the Chase Routing Number for Direct Deposits

If you get paid with direct deposits, knowing your Chase routing number is crucial. Your employer needs it to ensure that your paycheck lands where it should—your Checking account. Services like Metro Pay Bill may have additional instructions for submission, so double-check this info to avoid a misplaced deposit.

2.4. Comparing with Other Bank Routing Numbers

Let’s not forget that Chase isn’t the only game in town. If you’re transferring funds to someone at US Bank, for example, you’ll have to know the US Bank routing number. Each bank has its own system, and getting it wrong could lead to delays or even lost funds.

2.5. Mistakes to Avoid with Routing Numbers

A simple error in your routing number can throw your entire transaction into chaos. Triple-check the number you input, especially for larger transactions, like a Home Depot purchase or anything worth a substantial amount of money. No one wants to be responsible for sending cash to the wrong account.

3. Chase Bank Routing Number Tips for Small Businesses

For small business owners, the Chase routing number is especially important. Setting up automatic payments with vendors and managing payroll requires accurate routing information. If an employee mishandles this info, it could cost you time and money. It’s a good idea to designate one person to be the “routing number guru” in your office.

Businesses often juggle multiple accounts, especially if you have accounts across different states. Make sure you know which routing number to use, depending on the location of your account. This will help streamline your operations and keep transactions seamless.

Take payroll, for example. If employees rely on direct deposit, providing accurate information is crucial. A hiccup in this system could lead to disgruntled employees—no one wants that!

4. Customer Support and Routing Number Inquiries

Banking can sometimes feel overwhelming, especially when dealing with routing numbers. If you aren’t sure about what number to use, don’t hesitate to contact Chase customer service for help. They’re equipped to clear up any confusion and point you in the right direction.

The Chase website also offers resources that can assist you. Getting the right information can save you a lot of time—and potentially a lot of headaches. Remember, having all the facts at your fingertips makes managing your finances a lot easier.

5. Final Thoughts on Routing Numbers in the Digital Age

As our world becomes more digitized, the importance of understanding your Chase bank routing number can’t be overstated. It’s your key to getting payments, invoices, and other business transactions done without a hitch. Whether it’s sending money to a friend or handling your business’s financial dealings, knowing your routing number keeps things running smoothly.

In this fast-paced financial environment, having a solid grasp on your Chase routing number means you’ll be one step ahead. Don’t leave anything to chance—understand your routing number inside out, and you’ll navigate the financial landscape like a pro. So mark that number down, and keep your financial matters running like a well-oiled machine.

In closing, understanding your Chase bank routing number isn’t just a good idea; it’s a necessity. Keep yourself informed and ready for whatever financial adventures lie ahead, whether it be a new investment, a trip to the local Commerce Casino, or just ensuring you know every dime in your pocket is accounted for!

Chase Bank Routing Number: Secrets You Must Know

What’s in a Number?

Did you know the Chase Bank routing number isn’t just a series of digits? This unique identifier, often a lifeline in the banking world, helps guide your funds in the right direction. Each branch has its own routing number, which can change depending on where your account is based. For instance, someone with accounts in California might have a different number than someone in New York. If you’re trying to keep track of that, why not keep a free printable calendar handy to organize your banking details?

Fun Facts You Didn’t See Coming

Here’s a fun nugget: the Chase Bank routing number is evolving! Yes, the financial industry reacts to trends and needs, adapting its systems. For example, just like understanding your bac levels can reveal insights about your wellness, knowing how to read your routing number can give insight into operational efficiencies. Remember, if you’re ever in doubt about your numbers, you can always refer to resources, just like you might check an ap exam schedule when planning your study sessions.

Unlock the Mysteries

Now, if you’re diving deep, here’s something fascinating: the routing number can trace its roots back to the 1910s! Well, who would’ve thought banking had such history? Just like the career of Robert Oliveri from childhood to adulthood has unfolded over the years, the routing number has seen its fair share of changes. And let’s face it, deciphering these numbers might sound like a game of fib, where you think you’ve got the answer but need a little more digging to confirm.

So next time you need your Chase Bank routing number, remember – it’s more than just digits. It’s a gateway to your finances, just like finding your favorite fast food location in Chicago, like a Jack in the Box can satisfy a late-night craving!