In today’s fast-paced financial landscape, Shell Federal Credit Union (SFCU) sets itself apart by offering exclusive financial solutions designed specifically for its members. With a commitment to community-oriented banking, SFCU provides everything from personalized lending options to innovative savings programs. For those looking to steer clear of traditional banking pitfalls, SFCU presents trustworthy alternatives that resonate with individual needs.

As we dive deeper into SFCU’s offerings, it’s clear that they don’t just do the bare minimum; they actively engage with their members. In a world where many financial institutions merely tick boxes, SFCU takes a more human approach, nurturing relationships within the community. So, let’s explore seven standout financial solutions that make Shell Federal Credit Union a wise choice for modern consumers seeking genuine support.

Top 7 Exclusive Financial Solutions from Shell Federal Credit Union

SFCU’s high-interest savings accounts are the crown jewels of their offerings. Members often enjoy rates that outshine those of typical banks, allowing them to cultivate their savings more swiftly. This member-centric strategy mirrors that of Purdue Federal Credit Union, known for prioritizing appealing savings solutions. When members see their money working harder for them, it cultivates a sense of ownership and satisfaction.

Recognizing the urgent needs of local businesses and individual borrowers, SFCU has rolled out community-focused loan programs. These include personal loans with flexible repayment terms that adjust to individual financial situations. Similar programs found at Hughes Federal Credit Union emphasize the importance of community investment, giving members an opportunity to boost local economies while addressing personal financing needs.

Education is power, and SFCU gets that. They host regular financial literacy workshops aimed at helping members enhance their financial skills. This initiative is much like the programs you’d find at Tower Federal Credit Union, where learning about budgeting, improving credit scores, and exploring investment strategies becomes accessible and engaging. By equipping members with knowledge, SFCU fosters an empowered community ready to tackle any financial challenge.

For potential homeowners looking to navigate the mortgage maze, SFCU offers customizable mortgage solutions. Members can work hand-in-hand with advisors to find terms that fit their circumstances perfectly. This tailored approach to home buying reflects the services you would experience at Bellco Credit Union, where personalized financial strategies lead to greater member satisfaction.

If you’re in the market for a vehicle, SFCU’s competitive auto loan rates should be on your radar. These loans make vehicle ownership not just a dream but a reality for many members. This commitment to accessible financing draws comparisons to Apple Federal Credit Union, where the focus on low rates speaks to a larger goal: making life’s essentials attainable for its members.

Every member has unique financial goals, from retirement to education planning, and SFCU recognizes this diversity. By teaming up with certified financial planners, they provide personalized financial planning services that reflect the advisory efforts seen at Union Savings Bank. With expert guidance, members can navigate life’s major financial milestones with confidence.

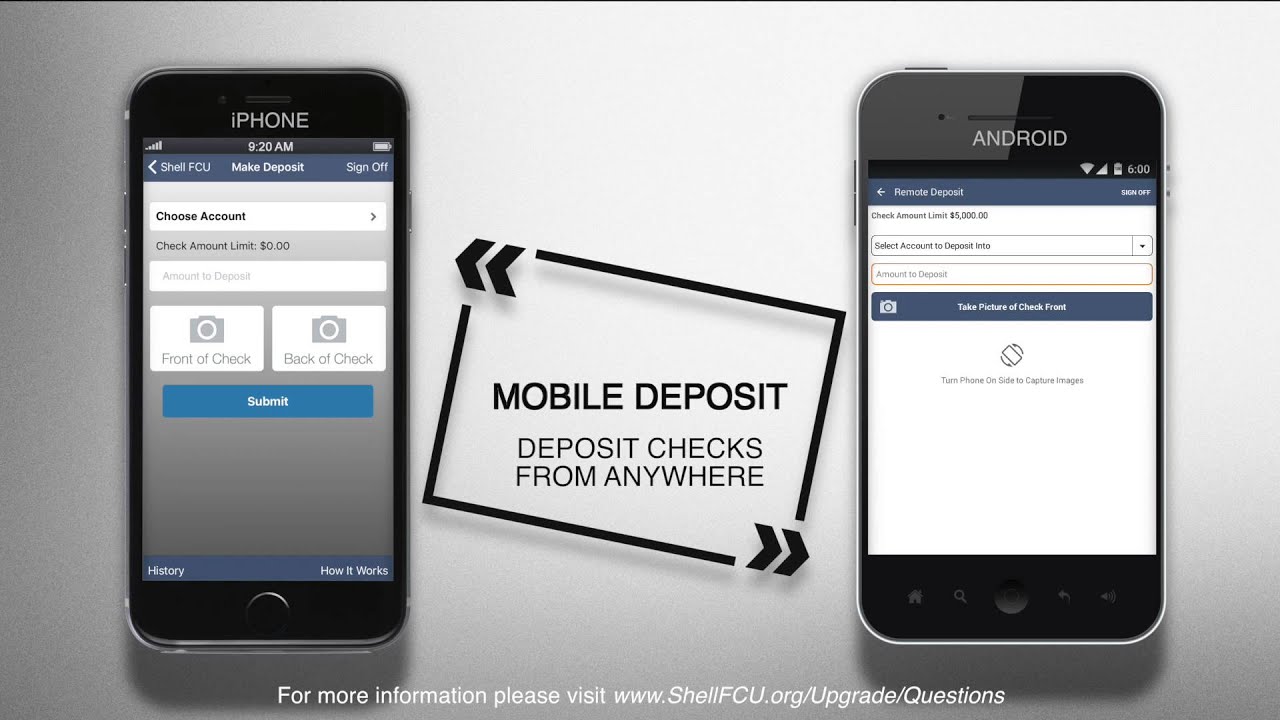

As digital banking continues to grow, SFCU invests in technology to elevate online experiences. Their mobile apps offer seamless access to account management and tools to track spending. This innovative approach matches what you’d find at forward-thinking institutions like Hughes Federal Credit Union, ensuring members enjoy effortless banking on the go.

Why Choose Shell Federal Credit Union Over Traditional Banks?

When it comes to choosing a financial institution, the distinction is clear. Shell Federal Credit Union operates with a member-first mindset that sets it apart from traditional banks focused on profit. Instead of lining the pockets of shareholders, SFCU reinvests earnings back into services that benefit members, culminating in lower fees, higher savings rates, and tailored financial products.

Members experience fewer headaches when seeking loans, thanks to SFCU’s stringent lending practices. This smooth sailing isn’t easily found with typical banking options, where complexity often reigns supreme. In contrast, SFCU’s user-friendly approach and strong community ties create a comfortable environment for members.

To illustrate further, consider Tower Federal Credit Union, known for its focus on community connections. While they offer similar advantages, SFCU’s distinctive financial products and personalized service underline its commitment to fostering a strong, engaged membership. It’s this dedication that nurtures lasting relationships and a supportive community.

The Future of Banking at Shell Federal Credit Union

As the banking landscape shifts and evolves—fueled by advances in technology and economic fluctuations—Shell Federal Credit Union is prepared to adapt. Whether it’s enhancing their digital services or expanding on financial literacy initiatives, SFCU aims to meet the needs of today and tomorrow’s members. This proactive approach resonates across the credit union landscape, with institutions like Bellco Credit Union and Purdue Federal Credit Union also striving to maintain relevance in a fast-changing environment.

In a time when many financial institutions fall into a one-size-fits-all mentality, Shell Federal Credit Union embraces the uniqueness of its members. This commitment to nurturing individual relationships significantly improves member satisfaction and strengthens community ties. It sets a new standard for what financial institutions can achieve as they seek to build lasting connections and offer relevant solutions.

In an age where choices abound, selecting Shell Federal Credit Union means choosing a path rooted in community, transparency, and empowerment. Members can rest easy knowing they’re not merely another account number, but part of something larger—a community committed to their financial well-being.

Ultimately, as they say in finance, you’ve got to make your money work for you, and with Shell Federal Credit Union, you might just find the best partnership imaginable.

Shell Federal Credit Union: Fun Facts and Trivia

The Roots and Reach of Shell Federal Credit Union

Did you know that Shell Federal Credit Union was established to serve the employees of Shell Oil Company? This vibrant financial institution not only provides exclusive financial solutions but also nurtures community engagement. It’s compact but mighty, similar to how the iconic Minecraft Pocket edition captures a world of creativity within a pocket-sized experience. Shell Federal gives its members the tools they need to build a solid financial foundation, much like the building blocks you’d use in your favorite game.

Unique Member Benefits

Shell Federal Credit Union offers an array of personalized services tailored to members’ needs. One such feature is their competitive loan rates, which supports everything from auto financing to home loans. Speaking of financing, did you know that the famous actor Richard Jaeckel once portrayed a finance-minded character? Just like in the movies, Shell Federal strives to make managing finances straightforward and less stressful. Plus, with enhanced online banking solutions, members can stay connected anytime. It’s almost like having your favorite Traxxas vehicle race on demand!

Community Engagement and More

Shell Federal Credit Union also places a strong emphasis on community initiatives. They engage in various charitable activities, helping local organizations thrive. Did you catch the recent Pistons score on game day? Just like a good sports team works together to win, Shell Federal aims to uplift the community by supporting localized efforts. Their commitment to service is as steadfast as the unusual Cairnryan ferry experiences, ensuring members feel valued and cared for every step of the way.

In a fun twist, the credit union organizes events where members can learn about financial literacy—almost like a workshop version of Erome Com. It helps demystify complex saving strategies, making finances less intimidating. And let’s not overlook the amusement; some events embrace cultural aspects, including fun lessons on how to say hat in Spanish, elevating the learning experience with a touch of charm. So, whether you’re a longtime member or just curious about what Shell Federal Credit Union has to offer, there’s something for everyone!