The USD to RMB exchange rate shapes not only global trade but also the financial decisions of businesses and individuals around the world. With economic policies and market sentiments at play, understanding how the USD RMB exchange rate operates in 2026 is essential. Whether you’re an investor looking to dive into international markets or someone planning a trip to China, getting a grip on USD RMB fluctuations is part of the game.

Understanding the USD RMB Exchange Rate Dynamics

The exchange rate between the US dollar (USD) and the Chinese yuan (RMB) is influenced by several key factors. From interest rate policies to economic performance indicators, each element plays a role in how the currencies interact over time. Grasping these dynamics gives professionals the insight needed to make informed decisions in both business and personal financial affairs.

Top 6 Factors Impacting the USD RMB Exchange Rate

The People’s Bank of China (PBOC) takes a cautious approach when it comes to interest rate adjustments. A tweak in the U.S. Federal Reserve’s policies, especially concerning rate hikes or cuts, stirs the pot in the USD RMB exchange rate. This volatility ripples through companies like Alibaba and Tencent, which depend heavily on cross-border trading.

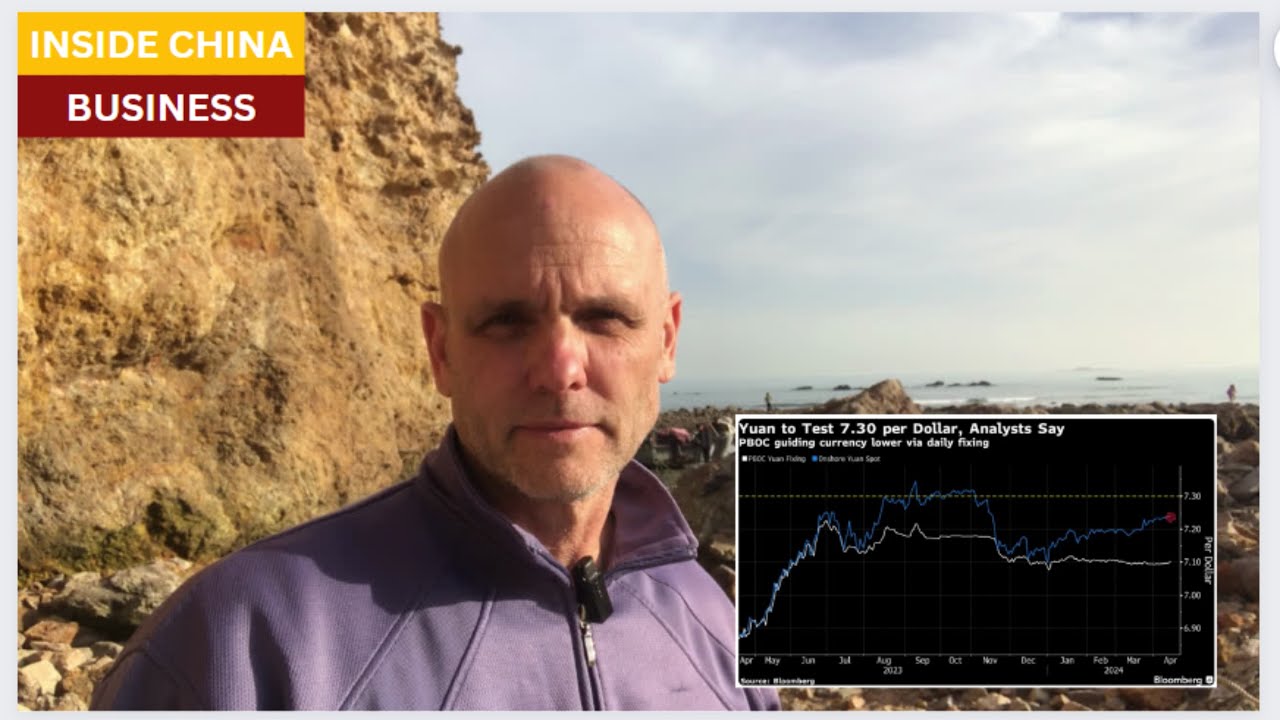

China’s GDP growth remains at the forefront of driving USD RMB rates. If China’s economy picks up steam faster than the U.S., traders may see the RMB strengthening. On the flip side, if growth slows, the RMB could take a hit. Consider how a recent report noted a slowdown in China’s exports, triggering speculation about potential RMB depreciation.

Trade policies between the U.S. and China directly affect the USD RMB rate. For instance, the tariffs enforced in past years strengthened the USD against the RMB, influencing large players like Ford and Boeing. The complex interplay of trade agreements often necessitates adjustments in pricing and strategies that ripple down through various businesses.

Investor confidence hinges on stability in the Asia-Pacific region, impacting the USD RMB exchange rate significantly. Unrest in places like Taiwan or disputes in the South China Sea create waves of uncertainty. Major companies, including Qualcomm, often find their strategies influenced by these tensions, shaping their market outlook.

The USD’s performance against other currencies like the Mexican peso (MXN) and New Taiwan Dollar (TWD) informs its strength relative to the RMB. For example, if the dollar shows strength against the MXN, it may indicate broader strength that could translate into a more favorable rate against the RMB. This analysis can set the stage for enhancing portfolio strategies across various industries.

As of 2026, inflation remains a pivotal factor affecting currency valuations. If inflation rises more steeply in the U.S. than in China, the USD could lose ground against the RMB. Brands like Apple and Nike, which share supply chains in both countries, may need to rethink their pricing models to account for fluctuating costs due to inflationary pressures.

The Broader Implications of USD to MYR and USD MXN Trends

Looking beyond the USD RMB exchange rate, trends between the USD and currencies like the Malaysian Ringgit (MYR) and the Mexican Peso (MXN) provide additional context. The USD MYR exchange rate, for example, reflects not just local economic shifts but also the overall health of the U.S. economy. Changes observed in USD MXN can often predict movements in the USD RMB rate, particularly affecting sectors tied to agriculture and energy.

Key Takeaway: Currency Interconnectivity in Global Markets

In today’s interconnected marketplace, changes in the USD RMB exchange rate don’t exist in a vacuum. They interact with other major currency pairs, influencing and being influenced by trends in the broader economy. For businesses analyzing the foreign exchange landscape, insight gained from fluctuations in the USD MXN and USD TWD exchange rates can provide predictive power regarding movements in the USD RMB rate.

As individuals and businesses navigate these turbulent waters, understanding the nuances behind currency interactions and economic indicators proves to be critical. Staying informed helps stakeholders anticipate potential changes and craft agile strategies for trade and investment. After all, when the tide shifts in currency exchange, those with a sound grasp of the details are the ones best equipped to ride the waves of fortune.

In closing, with the USD RMB exchange rate constantly on the move, adapting to these dynamics becomes essential for professionals and travelers alike. From inflation impacts to geopolitical events, being aware of these factors will undoubtedly make a difference in financial planning and investment success. After all, the only constant in currency exchange is change itself.

USD RMB: Fun Facts You Can’t Miss

The Currency Duo

Did you know the interaction between the USD and RMB isn’t just about trade and finance? The USD RMB exchange rate has a fascinating history, dating back to the opening of China’s economy in the late 20th century. Interestingly, the RMB was pegged to the dollar until 2005, making the shift to a more flexible exchange rate a big deal—like redoing a room in your house without needing a complete overhaul! With the RMB now having a significant role in global markets, it’s essential to keep an eye on its fluctuations. And if you’re making investments, understanding things like Tranches meaning can help you make smarter choices.

Cultural Connections

Now, here’s a fun twist: the cultural dynamics in China and the U.S. offer a rich backdrop to the USD RMB conversation. For instance, the love for balloon Animals made popular at fairs and parties can draw a parallel to how vibrant economies create diverse markets. Just like how you might enjoy a night in while trying different activities like connecting with Hyatt Connect, different currencies foster global connections. What’s wild is how the exchange rate can fluctuate with every ripple in international relations, affecting everything from your shopping list to investments in tech start-ups.

Innovations and Insights

The influence of technology also weaves intricately into the USD RMB narrative. For example, with the rise of e-commerce, understanding currency exchange has never been easier. If you don’t want to miss out on the best app for tracking rates, check out the latest reviews for the best Apple Watch that could help you stay updated. Likewise, keeping your financial data secure is crucial, and knowing how to view saved Passwords avoids unnecessary headaches in your online dealings. And let’s not forget the importance of staying informed about health trends like those highlighted in balance Of nature Reviews, as well-being can influence spending and investment behaviors.

In short, the USD RMB exchange isn’t just dry figures on a screen; it’s a lively dance blending economics, culture, and technology. So, keep your eyes peeled and your knowledge sharp as the USD RMB journey continues!