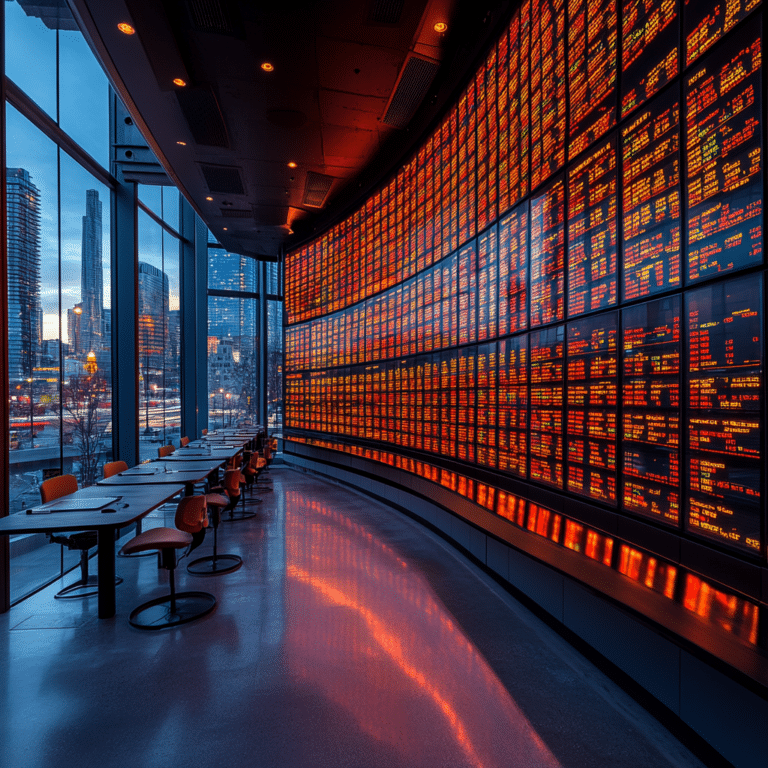

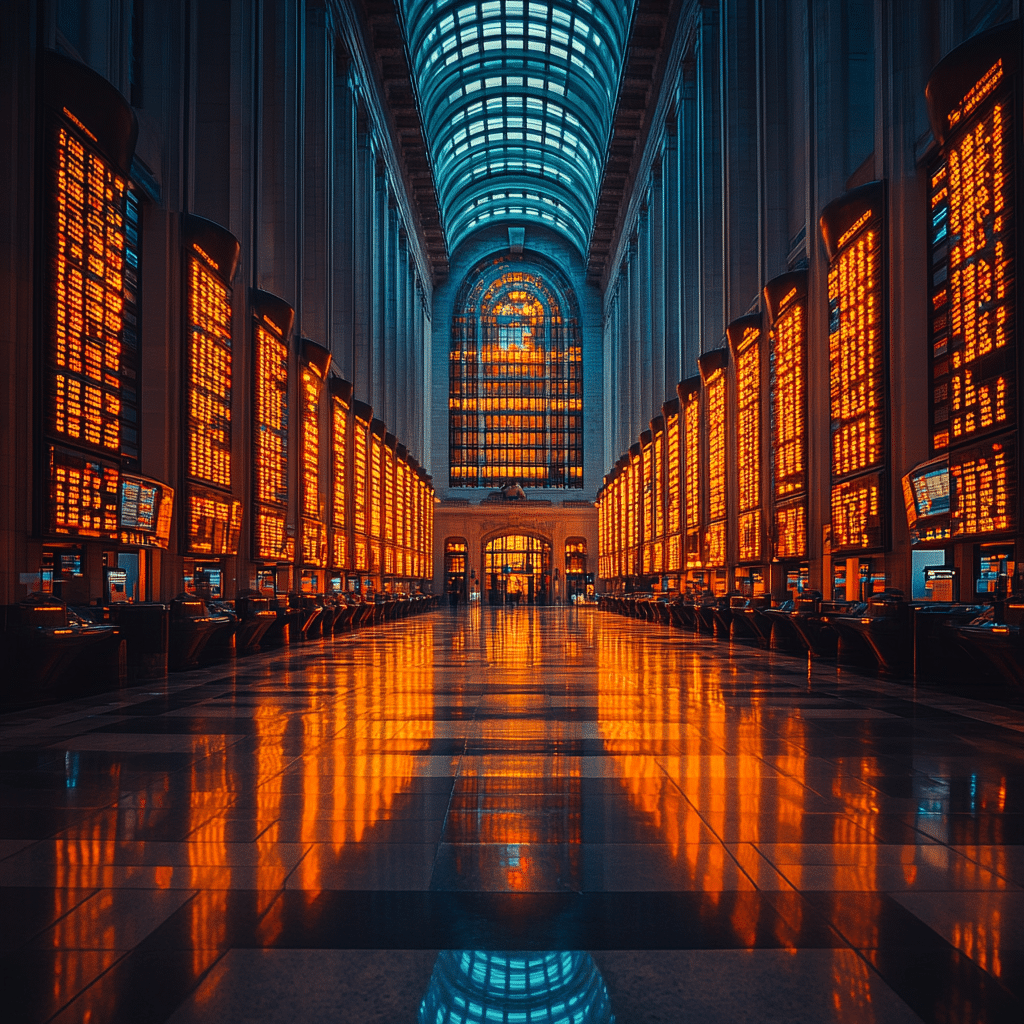

In the bustling world of technology investments, Vertiv stock (NYSE: VRT) has emerged as a noteworthy contender, promising strong growth potential ahead. This organization specializes in data center infrastructure, and there’s a palpable buzz around its prospects. As more businesses pivot to digital solutions and cloud computing, the demand for Vertiv’s products—especially in power and cooling—has received a significant boost. With a 20% year-over-year revenue growth reported in Q2 2024, it’s evident that Vertiv is not just keeping its head above water; it’s swimming ahead.

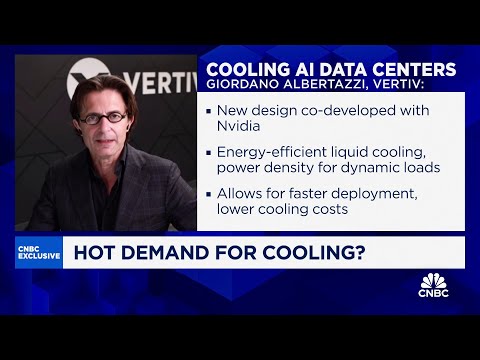

Vertiv is positioned robustly against recognized giants like Schneider Electric and Eaton Corporation, steadily increasing its market share in North America. The strategic decisions made by its leadership—primarily its focus on research and development—have sparked innovation, particularly in thermal management and power distribution. This foundation sets the stage for what lies ahead, making Vertiv stock a compelling option for those looking to invest in future technologies.

Diving deeper, it’s crucial to highlight contributing factors that are driving this upward trajectory for Vertiv. Investments and innovations are converging to create an impressive landscape for growth that’s hard to ignore.

Top 5 Factors Driving Vertiv Stock’s Growth Potential

1. Increased Data Center Demand

In today’s world, digital services dominate our daily lives, leading to an insatiable appetite for data centers. Major players like Amazon Web Services (AWS) and Microsoft Azure are pouring resources into infrastructure, triggering a domino effect. This surge translates to substantial contracts for Vertiv, positioning it favorably within the value chain. The digital footprint is only set to expand, providing the backbone for Vertiv’s continued success.

2. Technological Innovations

Wondering how Vertiv keeps racing ahead? Look no further than its innovative product lineup, featuring solutions like the Vertiv™ Geist™ Rack Power Distribution Unit (PDU) and Liebert® UPS systems. These offerings are not just any run-of-the-mill products; they put a spotlight on energy efficiency—a priority for tech firms today struggling with their environmental stewardship. This commitment to innovation sends a clear message: Vertiv is not just about keeping up; it’s about leading.

3. Strategic Mergers and Acquisitions

In the world of business, bigger often means better. Vertiv’s acquisition of American Power Conversion (APC) exemplifies this principle, enabling the company to scale its offerings and broaden its footprint. These strategic moves have enhanced Vertiv’s capabilities, allowing it to attract a wider range of customers while exploring new market segments. This diversified approach lessens dependency on a single revenue stream, providing a more stable financial future.

4. Solid Financial Performance

Nothing shouts “healthy business” louder than solid numbers. Vertiv’s effective management strategies have resulted in sustainable profit margins, which is critical for any company’s long-term growth. Analysts project a striking 15% increase in Earnings Per Share (EPS) within the upcoming year, reflecting confidence in Vertiv’s operational strategies. A strong financial performance acts as a magnet for potential investors, shining a spotlight on Vertiv stock as a golden opportunity.

5. Aggressive Expansion in Emerging Markets

While Europe and North America seem to have their data needs covered, emerging markets in Asia and Africa are popping up with unparalleled potential. Vertiv is keen to dive into these realms, establishing partnerships and building local manufacturing facilities to ensure a robust presence. Such moves showcase a willingness to adapt and enrich the company’s portfolio—a recipe for sustainable growth in the years to come.

Comparative Analysis: Vertiv Stock vs. MRVL Stock and ABPV

When it comes to making smart investments, comparing similar stocks can shed light on where the best opportunities lie. In this case, let’s pit Vertiv stock against MRVL stock (Marvell Technology, Inc.) and ABPV (Abbott Laboratories).

1. Growth in Technology and Semiconductors: MRVL Stock

Marvell Technology stands tall in the semiconductor realm, primarily targeting data infrastructure. With emerging trends like 5G and autonomous vehicles on its radar, MRVL exhibits impressive growth potential. However, sticking too close to the consumer electronics sector might expose its investors to cyclical risks, unlike Vertiv’s B2B focus. This competitive edge may just make Vertiv a wiser bet for growth-focused investors.

2. Stability in Healthcare: ABPV

While Abbott Laboratories brings a touch of stability to the table with its diverse range of consumer health products, diagnostics, and medical devices, its growth pace isn’t quite as exhilarating as Vertiv’s. If you’re after a defensive position in your portfolio with steady returns, ABPV might be appealing. But for those seeking rapid growth potential, the spotlight shines brightly on Vertiv stock—a much more dynamic option in this tech-savvy era.

Forward-Looking Statements: What to Expect for Vertiv Stock

So, what lies ahead for Vertiv stock? The horizon looks optimistic, thanks in part to its unwavering commitment to innovation and adaptability. Market analysts are buzzing with predictions, projecting that Vertiv will outperform the S&P 500 with a probability advantage of +6.57% over the next three months. This is backed by an impressive AI Score of 9/10—a strong buy signal if there ever was one.

Analysts also have a 12-month average price target set at $100.86, signaling a promising 14.76% upside potential. Even after the recent earnings report where Vertiv exceeded expectations but saw a slight dip in stock value, the strong demand for AI-related products in data centers keeps the future bright.

In a technology landscape that continues to evolve, Vertiv is not just a player—it’s a key architect in building the future of data infrastructure. With promising growth, strategic expansions, and an avant-garde approach to sustainability, Vertiv stock is one to keep an eye on. For investors, this stock represents a compelling mix of innovation and opportunity, making it a worthwhile consideration in the months and years ahead.

Vertiv Stock: Fun Trivia and Interesting Facts

Unpacking Vertiv Stock’s Value

Ever thought about why investors are buzzing about vertiv stock? Well, the company excels in critical digital infrastructure and continuity solutions. Did you know Vertiv’s growth strategy revolves around the surge in data consumption? As more people are glued to their devices, data centers are becoming essential. This aligns perfectly with trends seen across various industries, including the tech realm where My Asu Login proves vital for student engagement.

What’s even more intriguing is how vertiv stock connects to global economic indicators. Just like us bond rates can influence investor sentiment, the expected rise in smart technologies plays a big part here. As companies look to upgrade their systems, they might just turn to Vertiv for the latest innovations in energy efficiency. So, for savvy investors, this stock isn’t just another number; it’s the gateway to a booming sector poised for significant expansion.

The Impact of Social Trends on Vertiv

But it’s not all about hard numbers and forecasts. Trends in pop culture can indirectly influence investment strategies too. For instance, when celebrities like Cardi B make headlines, even with scandals like Cardi b Leaks, consumer attention shifts. This growing interest creates opportunities for brands like Vertiv to expand their digital infrastructure. Why? Because more views require more data processing power!

And speaking of impact, have you heard about lulu sun, the rising star in streaming? Growth in such platforms underscores the need for robust data solutions, meaning vertiv stock could see an upward trend as companies gear up to meet heightened demands. Additionally, the financial landscape plays a role—like understanding the perks of free Basing, where consumers benefit from increased access and lower prices, creating a ripe environment for Vertiv’s solutions.

Thriving in Dynamic Markets

In such a dynamic marketplace, diverse strategies matter even more. For instance, companies might seek the best kind of talent, much like the sky’s the limit for trailblazers like Tracey Kurland, who make waves in their industries. Vertiv is constantly adapting to these changes. As the need for efficient data management becomes clearer, those investing in vertiv stock find themselves tapping into a wellspring of potential.

With all this in mind, embracing developments in health tech and infrastructure—like understanding conditions such as asthenia—may even play a part in how businesses shape their future strategies. As the digital landscape rapidly evolves, investing in vertiv stock could be the key to unlocking exciting prospects moving forward. So, keep an eye on the trends and let curiosity guide your investments!

Is Vertiv a good stock to buy?

Vertiv’s got an AI Score of 9/10, signaling that it’s a buy, with a potential 6.57% chance of outperforming the market in the next three months.

Is Vertiv a publicly traded company?

Yep, Vertiv is publicly traded and is listed on the New York Stock Exchange under the ticker VRT.

What is the target price for Vertiv?

Analysts have set a 12-month average price target for Vertiv at $100.86, suggesting a nice 14.76% upside from current levels.

Why did Vertiv stock drop?

Recently, Vertiv’s stock dipped slightly after reporting better-than-expected earnings, even though demand from their data center customers has been strong, especially in AI.

What is the future of Vertiv stock?

The future for Vertiv’s stock looks promising, with strong demand trends, but investors should keep an eye on market conditions and company performance updates.

What is the outlook for Vertiv in 2024?

In 2024, analysts seem optimistic about Vertiv, especially with ongoing growth in AI and data center needs, but it’s always wise to stay tuned for any changes.

Who is Vertiv’s biggest competitor?

Vertiv’s biggest competitor is likely Schneider Electric, as they both provide similar power and cooling solutions for data centers.

Is Vertiv owned by Emerson?

No, Vertiv isn’t owned by Emerson anymore; it used to be part of Emerson Network Power but was sold off to private equity.

Who are the major shareholders of Vertiv?

Major shareholders of Vertiv include institutional investors and some private equity firms, reflecting a mix of investment interests in the company.

What does Vertiv do?

Vertiv specializes in providing essential power and cooling solutions for data centers, ensuring that technology continues running smoothly.

Who did Vertiv buy?

Vertiv recently acquired Energy Labs, enhancing their capabilities in energy efficiency and thermal management solutions.

How many people work for Vertiv?

Vertiv employs around 6,000 people globally, providing a broad range of technical and operational support across their services.

Is Vertiv Holdings a buy or sell?

With a solid AI Score and favorable analyst ratings, Vertiv Holdings is generally viewed as a buy, but investors should keep watch on market fluctuations.

Does Platinum Equity still own Vertiv?

Platinum Equity does still own Vertiv, having purchased it from Emerson back in 2016, and they’ve been active in driving the company’s growth since.

Does Eaton own Vertiv?

No, Eaton does not own Vertiv; they are separate companies, though they are both key players in the power management and cooling solutions market.